Brooklyn CPA, Kosher rates

To better meet the needs of our accounting and tax clients throughout the New York City area, we also have individualized services for clients in industries like Construction Accounting, Medical/Dental Accounting, Non-Profit Accounting, professional services and other service businesses. These individualized services have enabled us to address your industry specific challenges, compliance needs and industry standard tax practices.

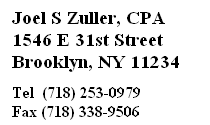

If you would like us to prepare your tax returns for you, please fax your information to (718) 338-9506 and we gladly will prepare your tax returns for you. If you would like to make an appointment and speak to Joel S Zuller, CPA directly, please call (718) 253-0979 or email Joel@zuller.com. The cost for this tax return preparation will vary based on complexity.

Online tax preparation includes: Federal, 2 states, all city & municipality tax returns. Additional states available for $20 per state. Returns processed under supervision of a CPA.

To prepare your own returns please click here

Prepare My Return

Do it Yourself

If you would like for us to prepare your tax returns on line, all you have to do is fill out our input sheets and fax it to (718) 534-8993. The fee for on line tax preparation is $125. It will include Federal & State tax returns. Your tax returns will be emailed to you in Adobe pdf format. After you checked your tax returns and agree that all information has been included correctly, we will e-file your tax returns to the Federal and State governments FREE of charge. For more information about this service, please contact us at SUPPORT .

We believe strongly in working with clients at their location. My staff and I serve all of New York City area, including Brooklyn, Manhattan, Queens, Staten Island and Bronx. Our clients located in multiple states, therefore we are experienced and knowledgeable in multi-state tax preparation.

Industry Specific Services

- Construction Accounting — general contractors, home builders, sub-contractors, and specific construction trade

- Medical and Dental Accounting — doctors, dentists, veterinarians, and related medical providers

- Non-Profits

- Professional Services — architects, legal, information technology and consulting services

- Consumer Services– electricians, plumbers, painters, and more

- All tax services

- Accounting and bookkeeping

Leave a Reply