You can’t go wrong at $5 per employee

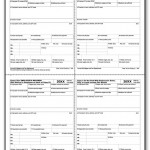

Sample W-2 Data Sheet

Printing of W-2 and 1099 Forms.

One of our major services is printing of W-2 and 1099 Forms. This service includes:

- W-2 Printing

- Printing of Payer Copy

- SSA Copy*

- Taxpayer copy (4 per page on perforated stock)

- Copy A*

- W-3 - Transmittal Form*

- W-3 Reconciliation

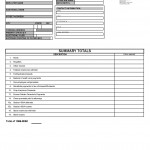

Sample 1099 Data Sheet

Forms Printing of 1099-MISC, 1099-DIV, 1099-INT

- Payer’s Copy

- Taxpayer’S Copy

- Form 1096 - Transmittal*

- 1096 Reconciliation

* Printed if NOT E-Filed

APPLICATION TO FILE ELECTRONICALLY

No application is needed for filing W-2′s with SSA. You will however need a PIN. You can apply for a PIN on the SSA Website. For 1099′s you need to file Form 4419, which is an application to file 1099′s electronically. You will be assigned a 5-digit Transmitter Control Code, which you will provide to us so that we can enter it into our software. Even though IRS states that the filing deadline for Form 4419 is 30 days prior to the due date of the return you will not be held to this requirement. IRS would love you to file in this manner and will accept the application up to the last minute. If you are submitting the application within the 30-day period mark “RUSH” on the application and inform them to contact you by telephone. Unlike other government agencies, the electronic filing division has their act together and will respond quickly. Once you have been assigned a Transmitter Control Code, you will use that number in subsequent filing years. When filing Form 4419, the IRS requests that you notify them which payors you will be submitting. A firm’s client list is very dynamic and always changing. All they want from you is an estimate. When it comes time to filing the payors you will include only the once you will be filling.

TRANSMITTAL FORMS

When you file on magnetic media, you are no longer required to file the transmittal forms W-3 and 1096. For W-2′s you do not need to send in a transmittal Form 6559 except if you are sending your data in on magnetic tape. Form 1099′s you only have to send in the transmittal Form 4804 if you do not have a PIN. A PIN for filing 1099′s can be obtained from their bulletin board by dialing 304-262-2400 on your modem and logging in. Our program can produce the necessary transmittal forms for you. Under no circumstances, are you to file Forms W-3 and 1096 along with the other transmittal forms as it will only confuse IRS/SSA and cause problems. Also never file paper forms in addition to a magnetic media file.

FILING DEADLINES

The filing deadline for submitting electronic files is always the last day in March of the following calendar year. We strongly recommend that you wait until the end of March to file your submission. The reason for this is that this provides you with plenty of time for corrections to come back from your recipients and to implement those changes before final submission. Remember, it takes more time to do piecemeal changes than to file an entire batch.

EXTENSION OF TIME TO FILE

If necessary you may file for an extension of time to report information on magnetic media (Form 8508)