1040 INDIVIDUAL

2011 Data sheets are ready

To try our system FREE of charge all you need to do is

Request FREE trial

1040 Individual Tax Returns Including 2 States

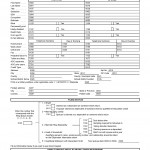

1040 Input Sheets

SAMPLES OF INPUTSHEETS

- 1040 LIGHT (Will cover about 70% – 85% of your taxpayers.)

This Data sheet includes the following forms:

- W-2 – Wages

- 1099-R Pensions and Annuities

- SSA – Social Security Benefits received

- Education Expenses – Will Be Optimized Unless Desired Method is Specified

- 1040 Schedule A - Itemized Deductions

- 1040 Schedule B – Interest, Dividends

- 1040 Schedule C – Self Employed Income

- 1040 Schedule D – Capital Gain & Loss including Prior Year Carryovers

- 1040 Schedule E -Rental Income or Loss

- 8829 – Use of home for business

- 2106 – Employee Business Expenses

- 8606 – Nondeductible IRA

- 8283 – Noncash Charitable Contributions

- 2441 – Child & Dependent Care Expenses

- 1040-ES – Estimated Payments (Federal & State including adjustment calculation for the following year, if any)

- 8867 – EIC – Earned Income Credit Paid Preparers Check List

- Other Income & Adjustments (Taxable scholarship, State Tax Refund, Alimony received, Unemployment compensation, Educator expenses, HSA, SE Health Insurance, Alimony Paid, Student Loan Interest Deduction, Tuition & Fees Deduction (Optimization Available), Jury Duty Pay.

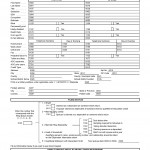

1040 Additional Data Sheets

1040 EXTENSIVE(Additional Input Sheets – All other Forms. This SetContains an Index Page Which Makes It Easy to Find Additional Forms That You Looking For – Will Cover 100% of Your Taxpayers)

1040 INDIVIDUAL FEATURES

- All 1040 states available

- All 1040 amended returns

- All states extension forms

- Extensive passive activity worksheets built in

- Education Expense Optimization

- Tax Projection Worksheet helps estimate tax liabilities for the next tax year

- Two-Year Tax Comparison Report illustrates tax differences from current tax year to previous tax year

1040 INDIVIDUAL WORKSHEETS

- Auto Expense

- Child Tax Credit

- Diagostics

- Earned Income Credit

- Education Expense Allocation

- Excess Social Security and RRTA Tax Withholding

- Exemption Deduction

- Form 1040-ES Estimate

- Form 1045 Itemized Deduction Limitation

- Form 1116 Foreign Tax Credit

- Form 2210 Underpayment of Estimated Tax

- Form 2555 Deductions Allocable to Exclude Income

- Form 2555 Foreign Earned Income Allocation

- Form 4952

- Form 6198 At-Risk Limitation

- Form 6251 Capital Gain and Exemption

- Form 8582 (I-6) Passive Activity Loss Limitation

- Form 8582-CR Passive Activity Credits

|

- Form 8615 Capital Gain Tax

- Form 8615 Tax for Children Under 14

- Form 8839 Adoption Credit Limitation and Carryforward

- Home Mortgage Limitation (A)(B)

- Home Office Deduction

- Home Sale

- Investment Income (Regular and AMT)

- IRA Distribution with IRA Contribution

- IRA (Traditional, Roth, and Education)

- Itemized Deduction Limitation

- K-1 Reconciliation

- Keogh, SEP & SIMPLE

- MAGI (for PAL)

- Late Filing Interest and Penalty

- Net Operating Loss (Regular and AMT)

- Pension Taxability

|

- Qualified Tuition Plan Contributions

- Qualified Tuition Plan Distributions

- Schedule D Capital Gain Tax and Carryovers

- Schedule J Farm Income Averaging

- Schedule SE Earnings Reconciliation

- SE Health Insurance Deduction

- Standard Deduction

- Student Loan Interest Deduction

- Tax Projection

- Taxable Social Security

- Taxable Social Security with IRA Contributions

- Taxable State and Local Income Tax Refund

- Tuition and Fees Deduction

- Vacation Home

|

1040 INDIVIDUAL REPORTS

- Carryover

- Depletion

- Depreciation

- Diagnostics

- Foreign Tax Credit Carryover

|

- IRA Distribution

- K-1 Summary

- Pension Distribution

- Preparer Review

- Taxpayer/Spouse Summary

|

- Two-Year Comparison

- Wages

- Withholding

- W2-G Gambling

|

1040 INDIVIDUAL STATES and LOCAL SOFTWARE

- Alabama

- Alaska

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- District of Columbia

- Florida (Tangible and Intangible)

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Kentucky Cities

- Louisiana

- Maine

|

- Maryland

- Massachusetts

- Michigan

- Michigan Cities

- Michigan SBT

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- New Hampshire

- New Jersey

- New Mexico

- New York (Includes New York City, Yonkers and MTA Surcharge)

- North Carolina

- North Dakota

- Ohio

- Ohio Cities

- Oklahoma

|

- Oregon (Includes Multnomah County and Portland City)

- Pennsylvania

- Pennsylvania Cities(Includes Philadelphia, Pittsburgh, and a Generic Pennsylvania City)

- Rhode Island

- South Carolina

- Tennessee

- Utah

- Vermont

- Virginia

- West Virginia

- Wisconsin

|

1040 INDIVIDUAL FORMS

|

1040

1040A

1040ES (NR)

1040-EZ

1040NR

1040NR-EZ

1040-V

1040X

1045

Schedule A-E, EIC, F, H, J, R, SE, C-EZ, D Alt. Min.

843

982

1116

1116 Alt. Min.

1310

2106

2106-EZ

|

2120

2210

2210F

2350

2441

2555

2555-EZ

2688

2848

3468

3520

3800, Pg. 1

3903

4136

4137

4255

4506

4562

4684

4797

|

4797 Alt. Min.

4835

4852

4868

4952

4952 Alt. Min.

4970

4972

5329

5884

6198

6198 Alt. Min.

6251

6252

6252 Alt. Min.

6478

6765

6781

8082

8271

|

8275

8282

8283

8332

8379

8396

8453

8582

8582 Alt. Min.

8582-CR

8586

8594

8606

8609

8609, Sch. A

8611

8615

8801

8812

8814

|

8815

8821

8822

8824, Pg. 1

8824, Pg. 2

8826

8828

8829

8830

8833

8834

8835

8839

8840

8843

8844

8845

8846

8853

8857

|

8859

8861

8862

8863

8867

8873

8874

8878

8879

8880

8881

8882

8884

8885

9465

TD F 90-22.1

SS-4

W-4

W-4P

W-7P

|