2011 Data sheets are ready

To try our system FREE of charge all you need to do is

Partnership Returns Including 5 K-1s, and State

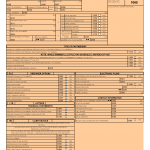

This is a SAMPLE of 1065 Data Sheets. If you would like to see a full sample, please click on REQUEST A FREE TRIAL and include which states you are interested in.

1065 PARTNERSHIP FEATURES

- All 1065 states

- Electronic Filing Federal & State (If state has capability)

- Handles multiple changes to profit sharing, loss sharing, and ownership of capital during the year for each partner, using a weighted average calculation

- Summary of rent and royalty properties

- Allocates any item based on absolute dollar, percentage, the greater of an absolute dollar amount or a percentage, or any combination

- Handles short-year and 52/53 week partnerships

- Ability to automatically transfer partners’ interest

1065 PARTNERSHIP FORMS, WORKSHEETS and REPORTS

|

|

1065 PARTNERSHIP AUTOMATIC CALCULATIONS

- Depreciation and amortization book/tax differences for Schedule M-1

- Reconciliation of Schedule L and Schedule M-2

- Section 179 expense limitations based on income and absolute statutory limit

- Self-employment net earnings for each partner

- Depreciation and section 179 recapture on sale of assets

- Calculation of recapture amounts under section 179 and 280F(b)(2) when business use of an asset drops to 50% or less

- Book Income

- Partner’s share of liabilities on Schedule K-1, line F

- Travel and entertainment limitations

- Ability to complete many composite returns

1065 PARTNERSHIP STATE and LOCAL

|

|

|

1065 PARTNERSHIP FORMS and SCHEDULES

|

1065 |

4255 |

8271 |

8716 |

8824, Pg. 2 |

8873 |

Leave a Reply