2011 Data sheets are ready

To try our system FREE of charge all you need to do is

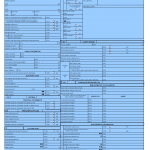

1120 Tax Return Including State

This is a SAMPLE of 1120 Data Sheets. If you would like to see a full sample, please click on REQUEST A FREE TRIAL and include which states you are interested in.

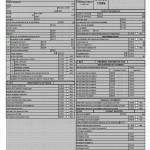

1120S Tax Return Including 5 K-1s and State

This is a SAMPLE of 1120-S Data Sheets. If you would like to see a full sample, please click on REQUEST A FREE TRIAL and include which states you are interested in.

1120/1120S CORPORATION FEATURES

- All 1120/1120S states

- Electronic Filing Federal & State (If state has capability)

- Transfer of all income, loss, and expense items needed to track AAA for S corporations

- Automatic Schedule L and M-1 rounding options

- Ability to enter Schedule K-1 information from other passthrough entities in one location for automatic transfer to forms

- Annualization of tax liabilities for short-year clients

- Multiple Forms 4562 for multiple activities including a summary

- Controlled group allocations and calculations for S and C corporations

- Automatic tracking of carryovers for NOLs, 1231 losses, capital losses, charitable contributions, general business credits, and the foreign tax credit from year to year

- Summary of rent and royalty properties for 1120S

- Handles short-year and 52/53 week clients including 2200 short-year calculations

- Prints a collated shareholder package with all the federal and state forms for each shareholder

- Ability to track shareholder stock and loan basis

- 1120S shareholder weighted average ownership percentages allowing up to 24 changes per year

- Ability to select which shareholder gets rounding amounts

- Ability to print shareholder Schedule K-1 instructions for each shareholder

- Handles up to 160 shareholders per 1120S Return

- Ability to enter all state apportionment information in one place

- Easily change client from C to S status

- 1120S shareholder calculations for termination of interest under IRC 1377(a)(2)

1120/1120S CORPORATION AUTOMATIC CALCULATIONS

- Calculation of recapture amounts under Section 179 and 280F(b)(2) when business use of an asset drops to 50% or less

- Special deductions for dividends

- Charitable contribution limitations

- Travel and entertainment limitations

- Net operating loss deductions

- Section 179 expense limitations

- Schedule M-1 book/tax differences including depreciation and amortization

- S as C Worksheet (shows taxable income of S-corporation as if it were a C-corporation)

- 1120S shareholder weighted average ownership percentages allowing up to 24 changes per year

- Large corporation estimated tax calculation

- Accrual of federal and state liabilities and the related page 1, Schedule L and Schedule M-1 adjustments

- Schedule M-1 net income per books

- Optimization between Form 1120H and 1120 for homeowners’ associations

1120/1120S CORPORATION WORKSHEETS

|

|

1120/1120S CORPORATION STATE and LOCAL SOFTWARE

|

|

|

1120 CORPORATION FORMS and SCHEDULES

|

851 |

1138 |

4797 |

8050 |

8824, Pg. 2 |

8874 |

1120S S-CORPORATION FORMS and SCHEDULES

|

1120S |

4466 |

6478 |

8697 |

8842 |

8884 |

Leave a Reply